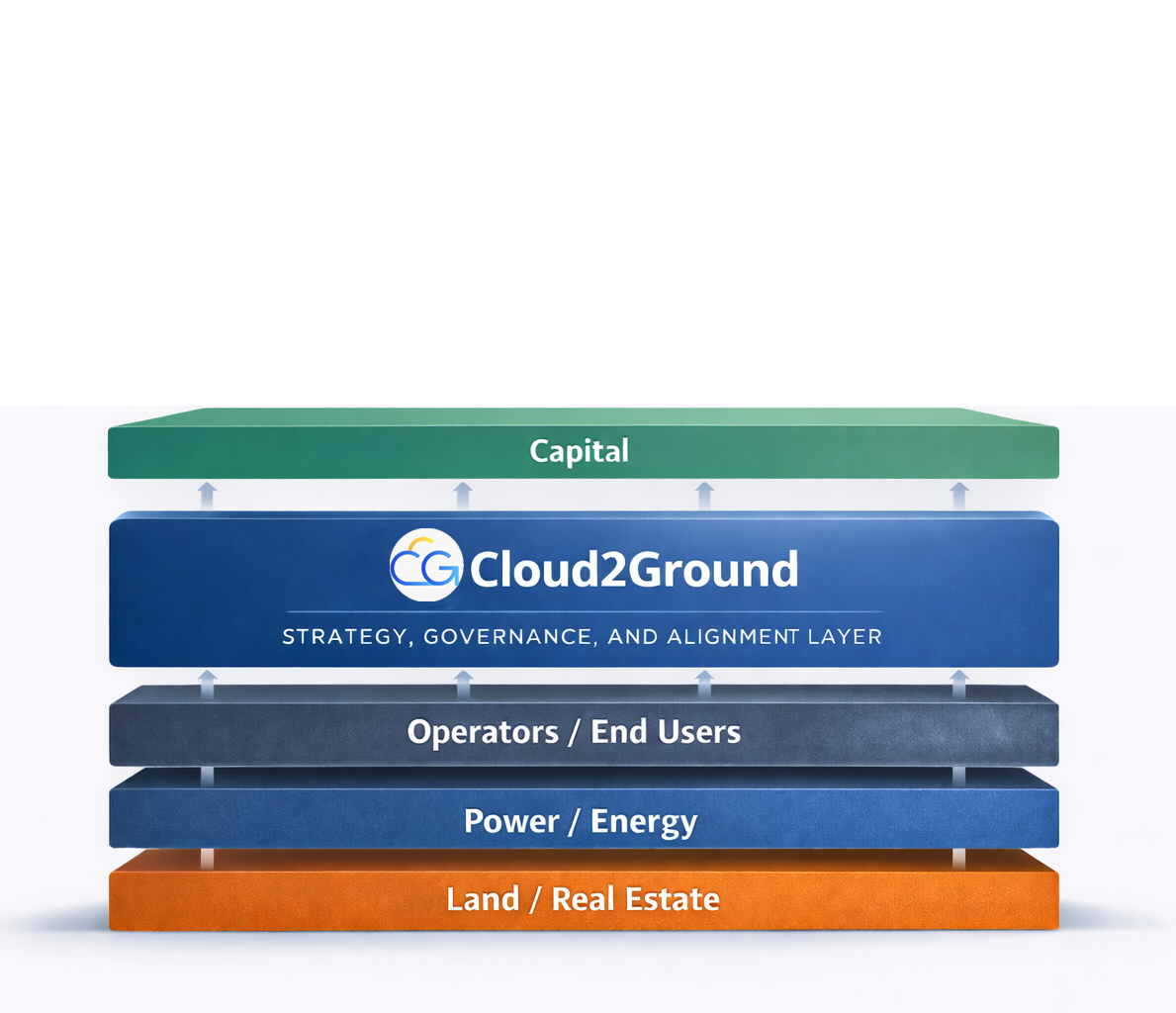

We help investors, operators, and developers align land, capital, and power realities into bankable, execution-ready AI infrastructure platforms.

Seasoned leadership across data center expansion, energy infrastructure, and institutional-grade commercialization.

Advisory services designed to reinforce one another—from powered land through capital and commercialization.

In AI infrastructure, power is the true constraint. We ensure strategies are grounded in what can actually be built.

Hadassa Lutz has over 20 years of experience bridging technology with business solutions, specializing in data center expansion, energy infrastructure, and commercialization strategies. She played a key role in CyrusOne's growth from a family-owned business to IPO, focusing on large-scale, sector-driven deals before leading enterprise teams in building and executing go-to-market strategies for technology-driven solutions companies.

Jeff Ferry brings a wealth of experience in financial strategy, investment, and digital infrastructure development to Cloud2Ground's Financial Consulting division. His strategic vision and extensive background in finance and digital infrastructure uniquely position him to guide clients through complex financial landscapes, ensuring their projects are both viable and profitable.

Todd M. Smith has nearly 20 years of experience specializing in the data center colocation, cloud, advanced connectivity and technology real estate arenas. Starting in 2007, Todd played a key role in CyrusOne's growth from a private equity held company with a few Texas based assets to a public company with a multi-national data center platform.

Dottie Spruce has 35 years in sales management with the last 20 years specializing in the hyperscale market within the data center industry. She played a strategic role at both CyrusOne and Iron Mountain Data Centers by leading all sales efforts to obtain, maintain and grow hyperscale customers.

Strategies grounded in what can actually be built, financed, and operated at scale.

Market engagement aligned with power feasibility and institutional expectations.

Coordinated execution without constraining clients to a single provider or path.

Execution pathways validated as realistic before capital is committed.